A tax rules and Taxes are different thing. If you want apply certain taxes to any of the product, based on the country, you need to use Tax Rules. You can use a tax rule to apply different taxes for the different countries (or states). You can use a single tax rule to apply different taxes to a product for different countries(or states).

To add new tax rules follow the below steps:

1. Add New Tax Rule Group:

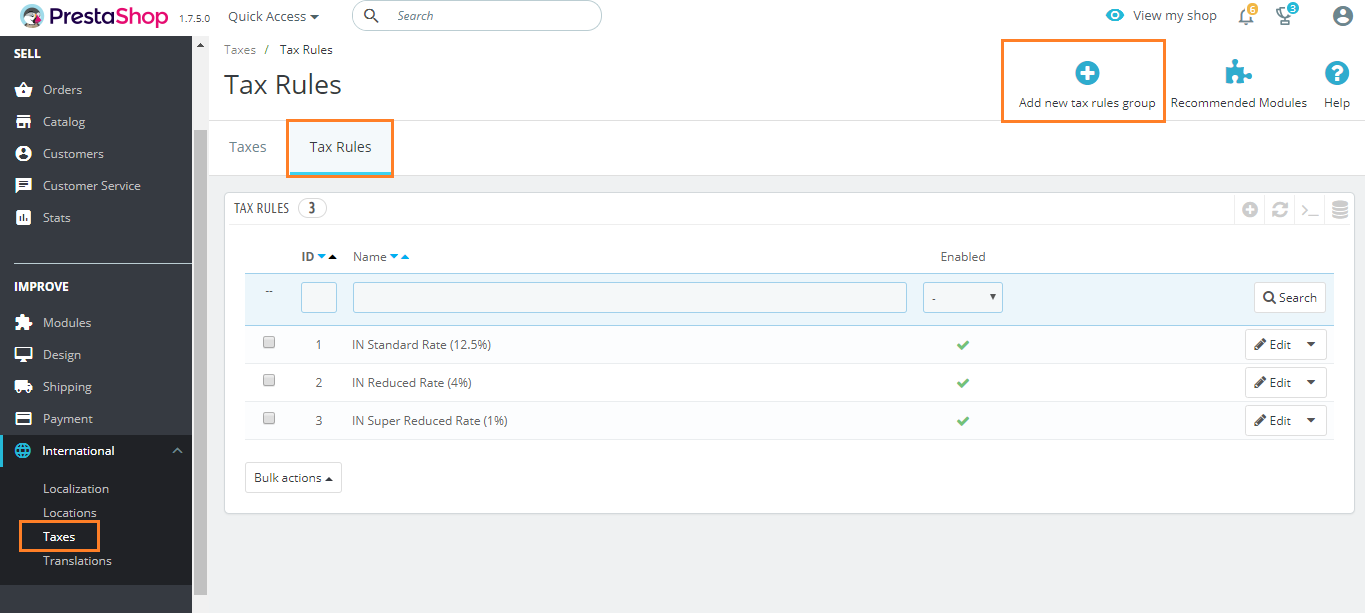

Go to: Back-Office > International > Taxes > Tax Rules (tab)

Click on “Add new tax rules group” button

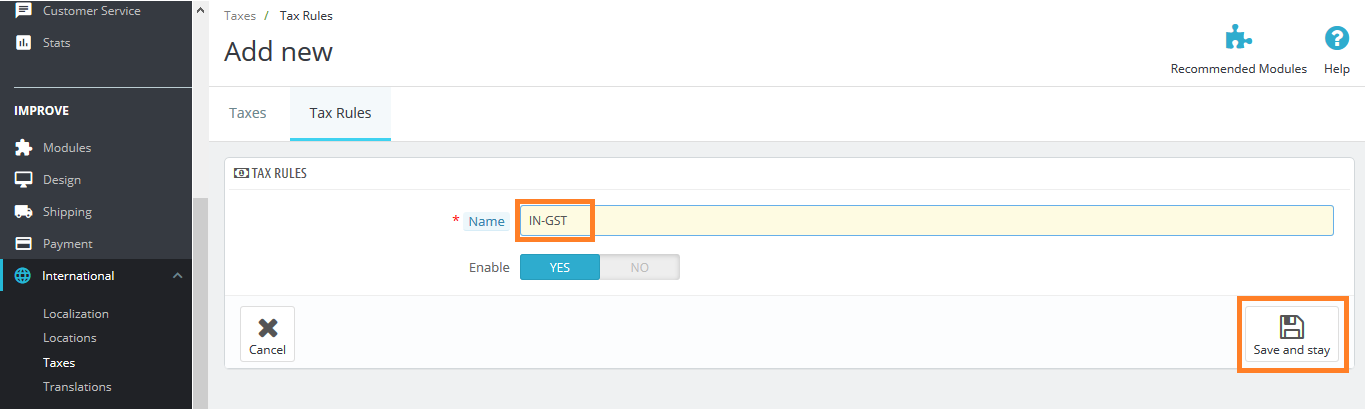

Name your tax rule, It’s good sense to use name that contains country name or tax rate because it will help to find out tax rule easily.

Then click on Enable to activate it and press Save and stay button.

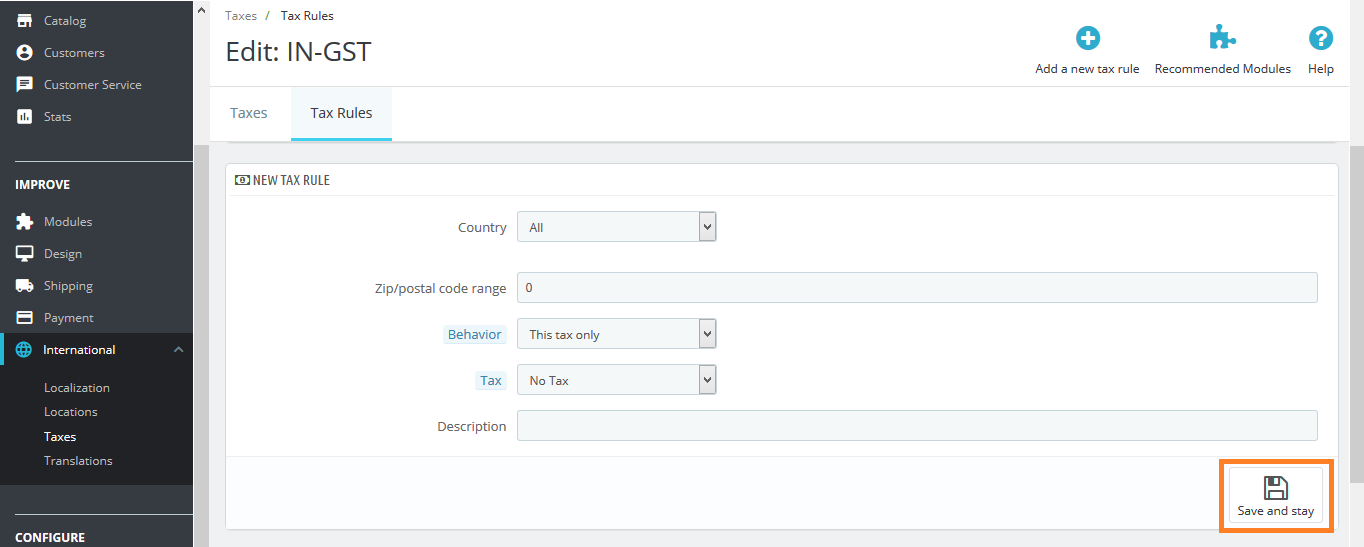

2. Specify the country, states and tax behaviour:

Here, you need to fill or select required options from the drop down:

Where,

Country: Select the country where you want to create current rule.

State: You will need to select the state in which the tax should be applied.

Zip/postal code range: Add customer’s zip code range.

Behaviour: Might be customer’s address can matches several tax rules, so you need to choose how this tax rule should behave:

- This Tax Only: It will only apply this tax.

- Combine: Combine taxes. For example: 200$ + (9% + 9% = 18%) => 236$

- One After Another: Apply taxes one by one. For example: 200$ + 9% => 218$ + 9% => 237.62$.

Tax: choose required tax option from the drop-down. - Description: Add short description for the tax rule.

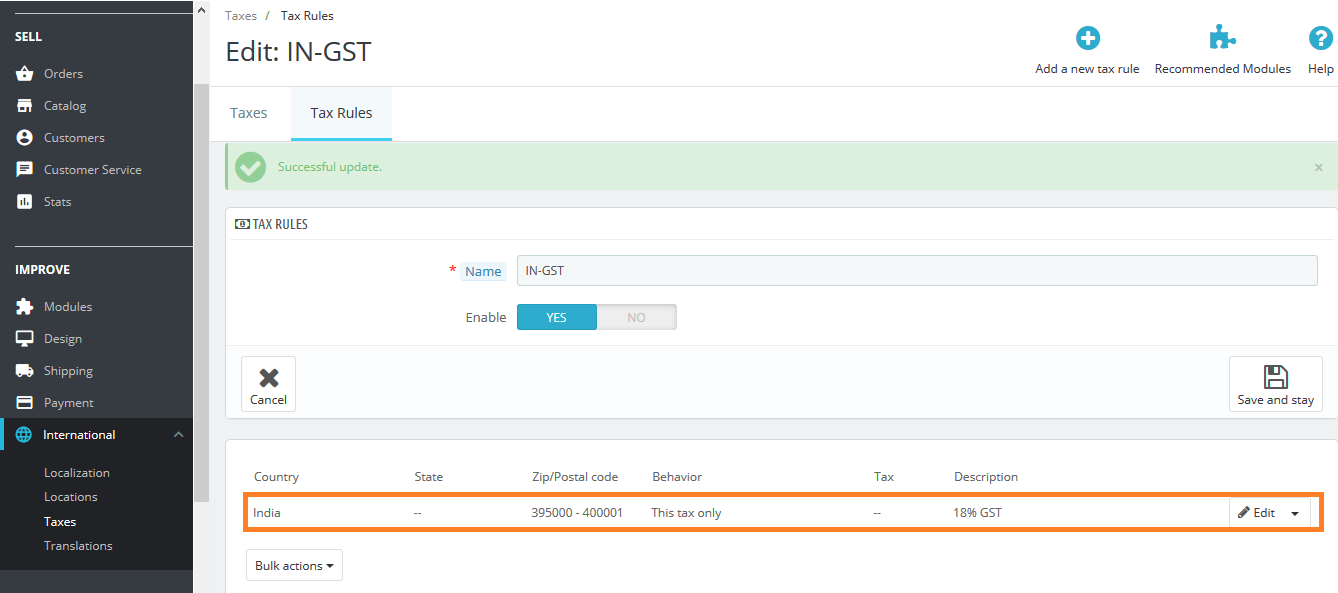

Now, click “Save and stay” button. The tax rule will be added to the list, and you can add tax rules for other countries in a same way.

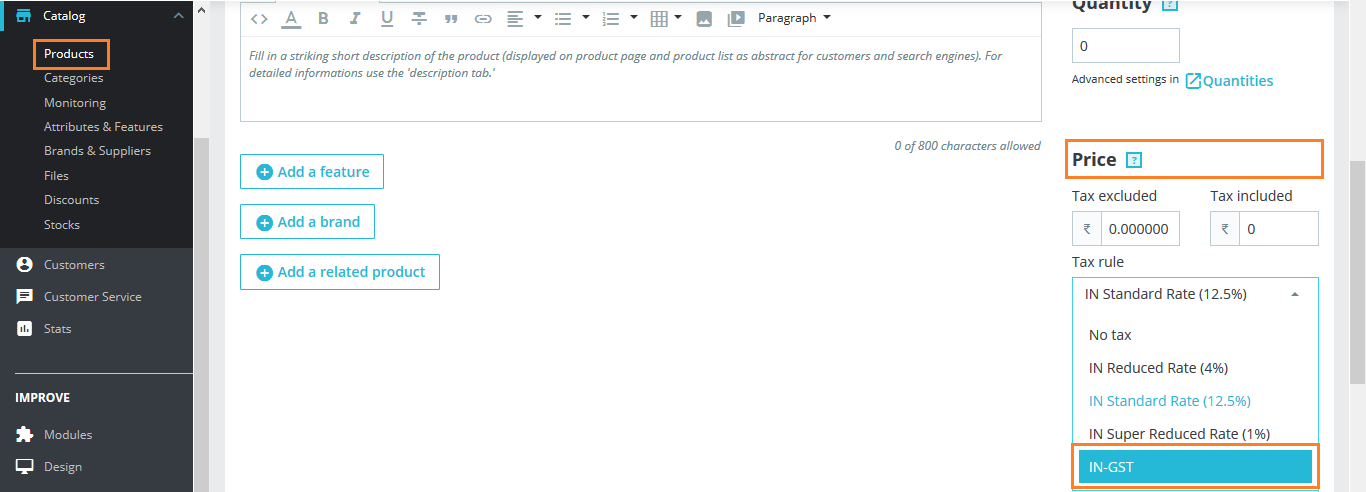

To apply this rule to any of the product. Go to: Catalog -> Products and select the listed product or add new product then specify the tax rule in the price section.

That’s all. If you have any doubts or question, you’re welcome to ask in comments.

Write an article about ecommerce that help people to grow their ecommerce business. You’ll find best ecommerce guide, news, tips & more!

Leave a Reply