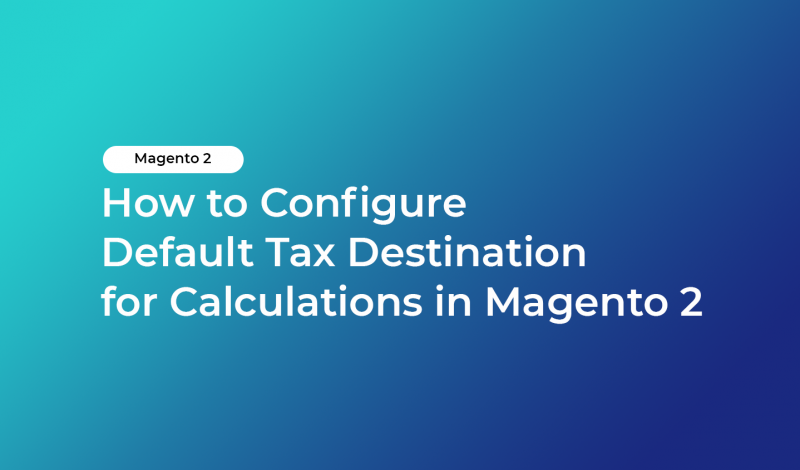

In this article we’ll show you, how to configure Default Tax Destination for calculations in Magento 2. Follow this simple guideline…

Step 1: Get Started

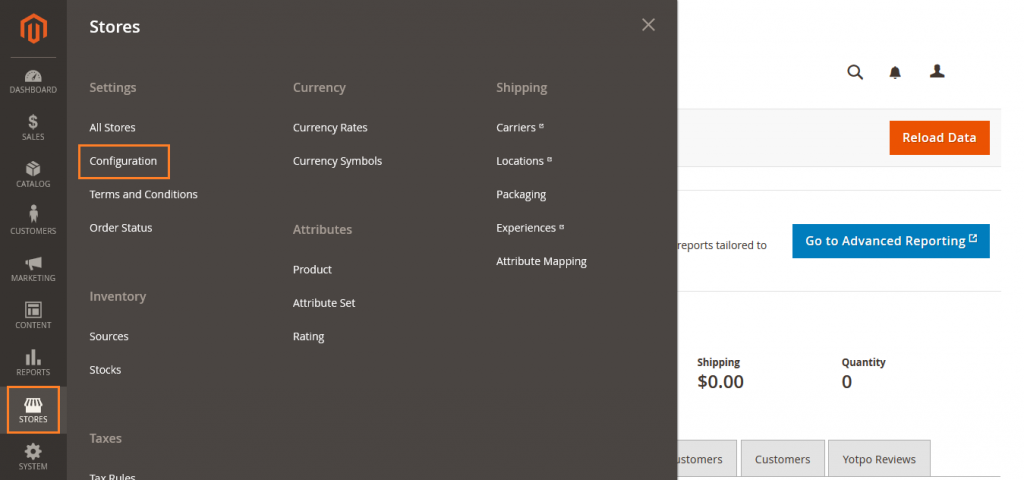

Login into Magento Admin Panel and from sidebar go to, Stores > Settings > Configuration

Step 2: Configure Default Tax Destination

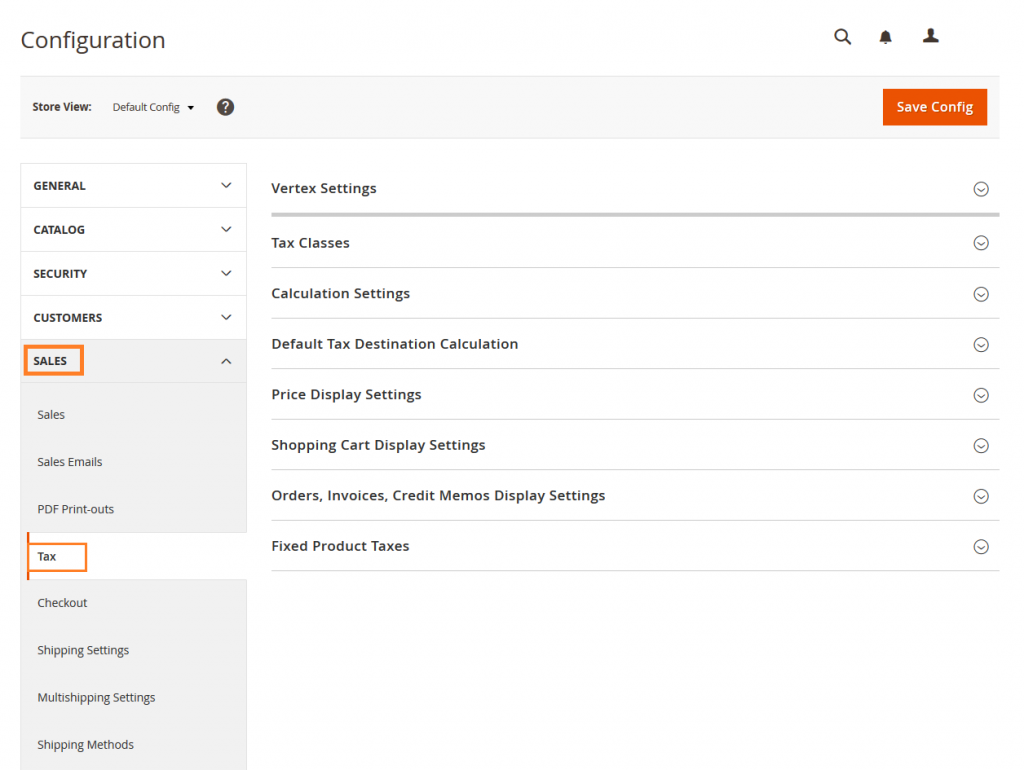

From sidebar go to Sales > Tax

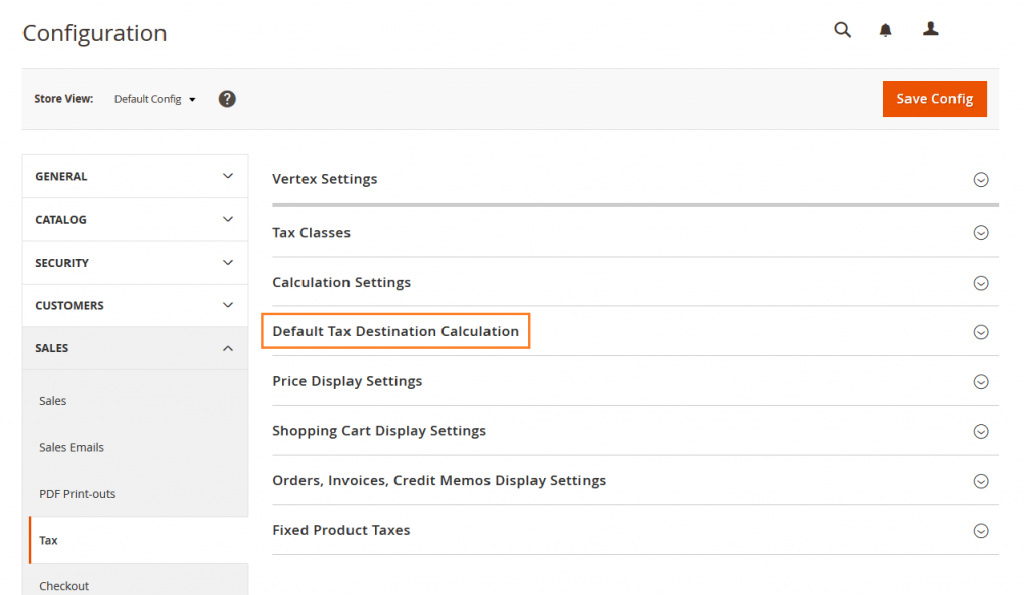

Expand the Default Tax Destination Calculation section.

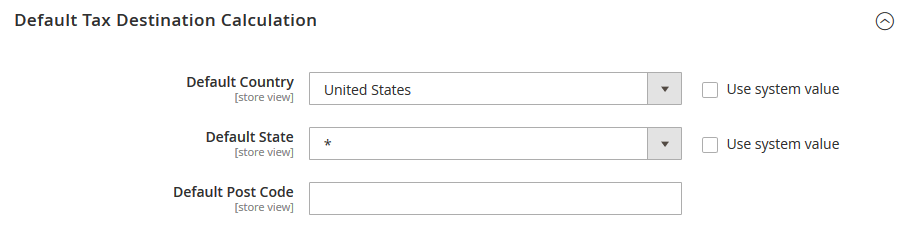

Here you can Configure Default Tax Destination.

- Default Country: Set Default Country to the country upon which tax calculations are based.

- Default State: Set Default State to the state or province that is used as the basis of tax calculations.

- Default Post Code: Set Default Post Code to the ZIP or postal code that is used as the basis of local tax calculations.

When complete, Click on Save Config button.

![]()

Yeah Done! Let us know in the comment section below if you have any question. We are happy 🙂 to help you! Check out Best Magento Tutorials here!

Write an article about ecommerce that help people to grow their ecommerce business. You’ll find best ecommerce guide, news, tips & more!

Leave a Reply